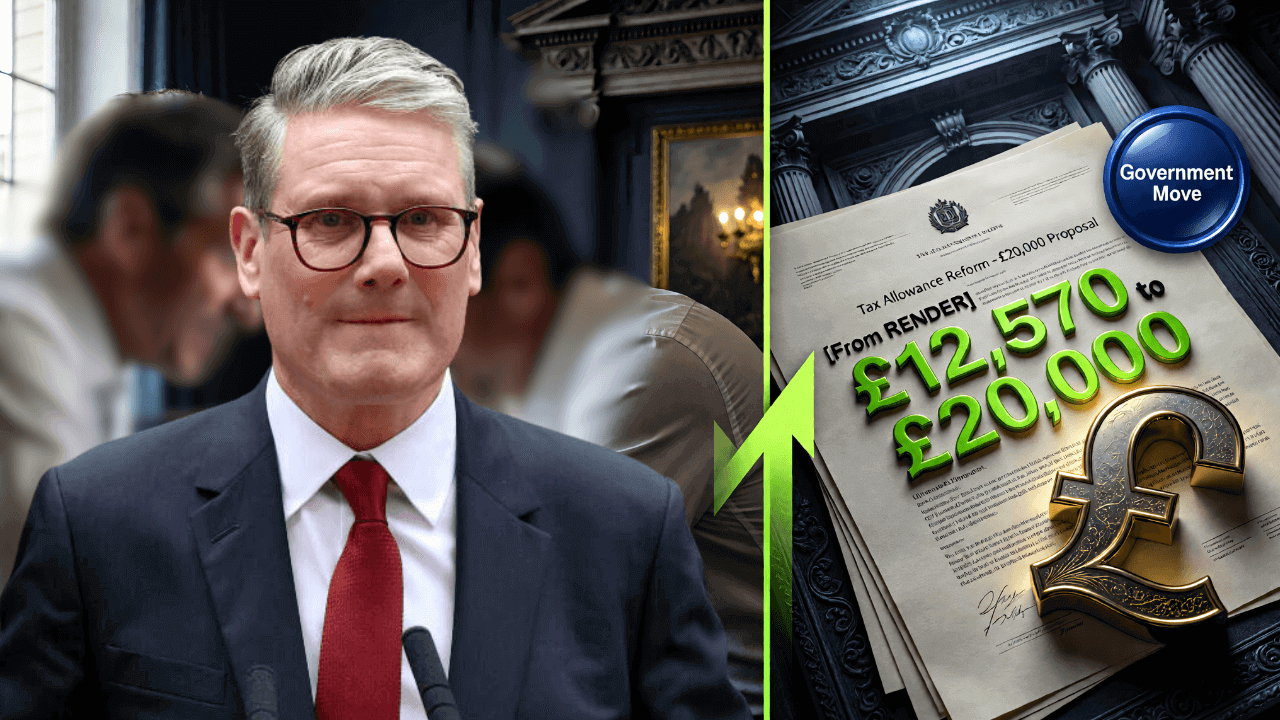

A proposal to raise the UK Personal Tax Allowance from £12,570 to £20,000 has sparked widespread discussion among workers, pensioners and businesses alike. The Personal Allowance determines how much income you can earn before paying income tax, so any significant increase would affect millions of people across the country.

At present, the Personal Allowance remains frozen at £12,570 — a figure that has been in place for several years. A move to lift that threshold to £20,000 would represent one of the largest changes to income tax policy in modern times.

But what would it actually mean for households? Who would benefit most? Would everyone pay less tax? And is this change confirmed or still under discussion?

Here’s a clear and detailed breakdown of what raising the Personal Allowance to £20,000 could mean in practical terms.

What Is the Personal Tax Allowance

The Personal Allowance is the amount of income you can earn each tax year before paying income tax.

It applies to most forms of income, including:

Employment earnings

Private pensions

The State Pension (although paid without deductions)

Rental income

Self‑employment profits

Currently, the allowance stands at £12,570.

If your total income exceeds this amount, income tax is applied to the portion above the threshold.

Why the £12,570 Threshold Matters

Because the allowance has been frozen while wages have gradually increased, more workers have been drawn into paying tax. This effect is often referred to as “fiscal drag.”

When wages rise but the tax‑free threshold does not, a greater share of income becomes taxable.

For example:

Someone earning £13,000 currently pays tax on £430.

Someone earning £18,000 pays tax on £5,430.

If the allowance were raised to £20,000, both individuals would pay no income tax at all.

That’s why the proposed increase is attracting so much attention.

What Would a £20,000 Allowance Mean

If the Personal Allowance rose to £20,000:

Anyone earning £20,000 or less would pay zero income tax.

Millions of basic‑rate taxpayers would see reduced tax bills.

Lower‑income workers would keep more of their wages.

For someone currently earning £20,000 per year, the tax saving could be around £1,486 annually (20% of the difference between £20,000 and £12,570).

That represents a meaningful boost in take‑home pay.

Impact on Basic‑Rate Taxpayers

Basic‑rate taxpayers currently pay 20% on income above £12,570 up to the higher‑rate threshold.

Raising the allowance would mean:

Less income taxed at 20%.

Higher disposable income.

Potentially improved household spending power.

For workers earning £25,000 per year, the taxable portion would shrink significantly, reducing overall income tax liability.

Impact on Pensioners

Pensioners whose income slightly exceeds £12,570 could benefit considerably.

As the full new State Pension continues to rise, it edges closer to the tax threshold.

A higher allowance would mean fewer pensioners are drawn into income tax purely because of annual pension increases.

For older households relying on modest private pensions alongside the State Pension, the change could simplify tax arrangements.

What About Higher‑Rate Taxpayers

Higher‑rate taxpayers would also benefit, as the first £20,000 of income would be tax‑free.

However, the proportional benefit would be greater for lower earners.

The higher‑rate threshold itself would still determine when 40% tax begins to apply.

Without adjusting that band as well, only the lower threshold would change.

Cost to the Treasury

A rise from £12,570 to £20,000 would come at significant fiscal cost.

Income tax is one of the largest sources of government revenue.

Increasing the allowance by such a large margin would reduce tax receipts substantially.

That raises questions about how the shortfall would be funded — through borrowing, spending cuts or alternative tax changes.

The proposal would require careful consideration by HM Treasury before implementation.

Economic Arguments in Favour

Supporters argue that raising the Personal Allowance would:

Support low‑income workers.

Reduce reliance on benefits.

Stimulate consumer spending.

Reward employment.

By allowing workers to keep more of their earnings, the policy could improve financial resilience.

It may also simplify the tax system for those on modest incomes.

Economic Arguments Against

Critics raise concerns including:

High cost to public finances.

Potential inflationary pressure.

Reduced funding for public services.

There is also debate about whether targeted support for low earners may be more efficient than across‑the‑board tax cuts.

Balancing fairness with fiscal responsibility remains a central policy challenge.

Interaction With Universal Credit

Many lower‑income workers also receive Universal Credit.

If take‑home pay increases because of a higher tax‑free allowance, Universal Credit payments may adjust downward due to the taper system.

For every £1 earned above a work allowance, Universal Credit reduces by 55p.

However, claimants would still generally be better off overall.

Could This Replace Other Support

It is important to note that raising the Personal Allowance does not automatically replace targeted cost‑of‑living support schemes.

It would be a structural tax change rather than a one‑off payment.

Households currently receiving winter payments or energy support would not automatically lose eligibility unless other policies changed.

Is the Change Confirmed

As of now, a move to £20,000 remains a proposal rather than enacted legislation.

Tax threshold changes require approval through the annual Budget process.

Until legislation is passed, the current allowance remains £12,570.

Any confirmed change would be announced formally and accompanied by an implementation date.

What Workers Should Watch For

If the policy progresses, workers should look out for:

Official Budget announcements.

Payroll updates.

Revised tax codes.

HMRC communications.

Income tax changes are typically implemented at the start of a new tax year in April.

What It Means for Employers

Employers would need to update payroll systems to reflect the new threshold.

Tax codes would be adjusted automatically by HM Revenue and Customs.

Employees should check their payslips to ensure changes are applied correctly once implemented.

Broader Political Context

Tax policy is often at the centre of political debate.

Raising the Personal Allowance to £20,000 would represent a major shift in fiscal strategy.

Such a change would likely feature prominently in public discussions about economic priorities, fairness and long‑term sustainability.

Whether it proceeds depends on wider economic conditions and government policy direction.

Key Points to Remember

The current Personal Allowance is £12,570.

A proposal suggests raising it to £20,000.

Lower‑income earners would benefit most proportionally.

The policy is not yet enacted.

Budget approval would be required before implementation.

Final Thoughts

The idea of increasing the Personal Tax Allowance from £12,570 to £20,000 has clear appeal, particularly for workers and pensioners feeling pressure from rising living costs.

For many households, the difference in annual take‑home pay would be substantial.

However, major tax changes carry complex economic consequences. The government would need to balance relief for taxpayers with maintaining funding for essential services.

For now, the current threshold remains in place.

If you’re planning your finances, continue working with the £12,570 allowance unless official legislation confirms otherwise.

Staying informed and reviewing your payslips regularly ensures you understand exactly how tax policy affects your income — both now and in the future.