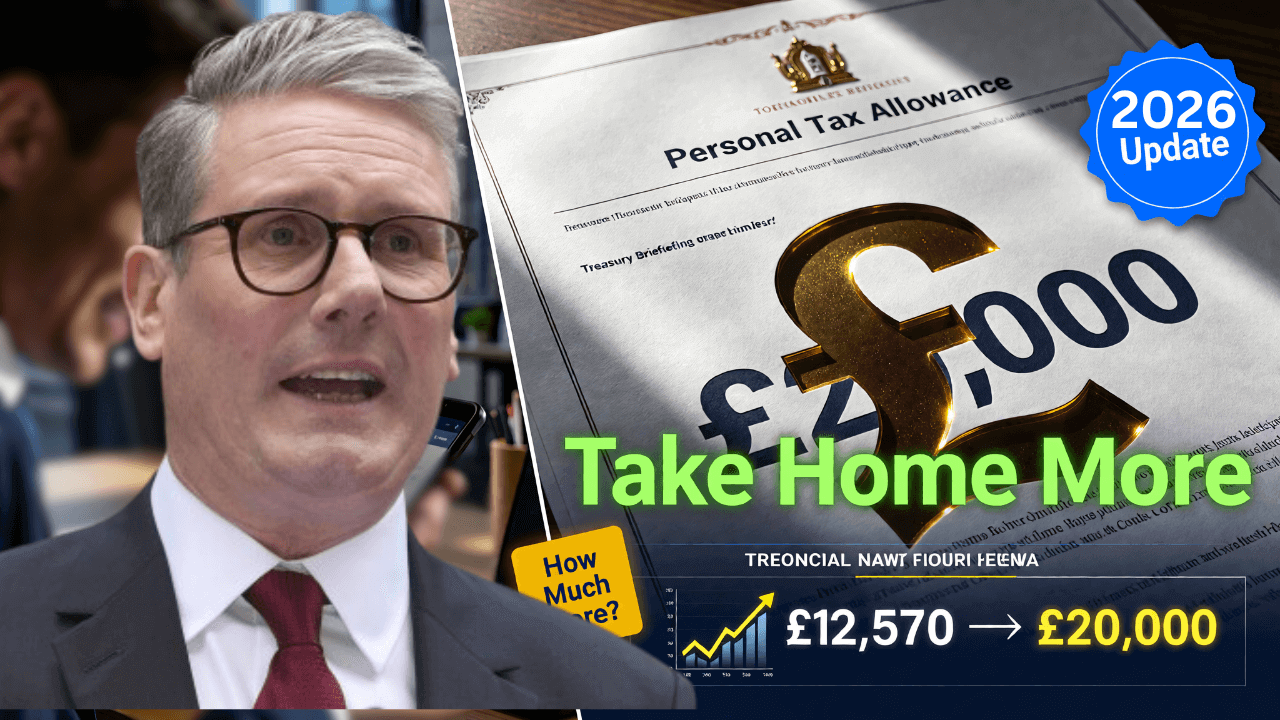

Few tax announcements grab attention quite like changes to the Personal Allowance. After all, this is the portion of your income you’re allowed to earn before paying any income tax. So when reports suggest the UK Personal Allowance could rise to £20,000 in 2026, it’s no surprise people are asking the same question: how much more money would that actually mean in your pocket?

At present, the standard Personal Allowance sits at £12,570. Increasing it to £20,000 would represent one of the most significant tax threshold changes in decades. But what would it mean for workers, pensioners and families across the country? And is it confirmed policy or still under discussion?

Here’s a clear, practical and balanced guide explaining what a £20,000 Personal Allowance would mean, who benefits most and how it could affect your take‑home pay.

What Is the Personal Allowance

The Personal Allowance is the amount of income you can earn each tax year without paying income tax.

In most cases, this applies to:

Employment income

Self‑employment profits

Pension income

Rental income

If you earn above the Personal Allowance threshold, income tax is charged on the portion above that limit.

The tax system is administered by HM Revenue & Customs.

The Current Threshold

As things stand, most people can earn £12,570 tax‑free per year.

Income above that amount is taxed at:

20 percent (basic rate)

40 percent (higher rate)

45 percent (additional rate)

The majority of workers fall into the 20 percent basic rate band.

What a £20,000 Threshold Would Mean

If the Personal Allowance increased to £20,000, the first £20,000 of your income would be tax‑free.

That means an extra £7,430 of income would no longer be subject to the 20 percent basic rate.

For basic rate taxpayers, this could result in tax savings of:

£7,430 × 20 percent = £1,486 per year

That equates to roughly £123 more per month in take‑home pay.

For many households, that’s a noticeable difference.

Who Would Benefit Most

The biggest beneficiaries would be:

Low and middle‑income earners

Part‑time workers

Pensioners with modest retirement income

Dual‑income households

Those earning below £20,000 would pay no income tax at all.

This could remove millions of lower earners from the income tax system entirely.

Impact on Pensioners

The State Pension is taxable income.

If the Personal Allowance rose to £20,000, many pensioners whose income currently slightly exceeds £12,570 would no longer pay income tax.

For example:

A pensioner receiving £15,000 per year currently pays tax on the portion above £12,570.

Under a £20,000 allowance, they would pay no income tax at all.

This could significantly reduce administrative burden and improve net income.

What About Higher Earners

Higher earners would also benefit from the increased tax‑free portion, though their total savings may be proportionally smaller compared to overall income.

However, it’s important to note that the Personal Allowance is reduced once income exceeds £100,000.

For every £2 earned above £100,000, £1 of Personal Allowance is withdrawn.

A £20,000 threshold would change the starting point, but taper rules may still apply.

Is This Officially Confirmed

As of now, a £20,000 Personal Allowance has been discussed in political and economic debates but would require formal Budget confirmation.

Tax threshold changes must be announced by the Chancellor and approved by Parliament.

Until legislation is passed, the current £12,570 threshold remains in place.

How It Would Affect Take‑Home Pay

Let’s look at a few examples.

Someone earning £25,000 per year:

Currently pays 20 percent tax on £12,430.

Under a £20,000 allowance, they would pay 20 percent on only £5,000.

That’s a potential annual saving of £1,486.

Someone earning £40,000:

Currently pays 20 percent tax on £27,430.

Under the new allowance, tax applies to £20,000.

The saving remains the same £1,486 at the basic rate.

National Insurance contributions would still apply separately.

National Insurance Is Separate

It’s important to remember that National Insurance thresholds are separate from income tax thresholds.

Even if the Personal Allowance increases, National Insurance contributions may still apply to earnings above their respective limits.

This means total deductions would not disappear entirely.

Effect on Universal Credit and Benefits

Higher take‑home pay could affect means‑tested benefits such as:

Universal Credit

Housing Benefit

Council Tax Reduction

For some households, increased net income could reduce benefit entitlement.

However, many working families would still see an overall gain.

Economic Arguments in Favour

Supporters argue that increasing the Personal Allowance:

Boosts disposable income

Supports low‑income workers

Reduces tax complexity

Encourages employment

By allowing people to keep more of what they earn, proponents believe consumer spending would rise.

Arguments Against

Critics point out:

It reduces government tax revenue

High earners benefit alongside low earners

Funding gaps must be addressed elsewhere

Balancing tax cuts with public spending commitments remains a central challenge.

What Would Happen to Tax Bands

If the Personal Allowance rises to £20,000 but tax bands remain unchanged, the basic rate threshold may shift accordingly.

Alternatively, the government could adjust band limits simultaneously.

Precise design would determine who benefits most.

Could This Happen Gradually

Large tax threshold changes are often phased in over several years.

Rather than an immediate jump to £20,000, increases could occur incrementally.

Gradual implementation reduces fiscal shock.

Regional Impact

The Personal Allowance applies across England, Wales and Northern Ireland.

Scotland sets its own income tax bands but still uses the UK‑wide Personal Allowance structure.

Therefore, Scottish taxpayers would also see changes to the tax‑free portion.

Self‑Employed Workers

Self‑employed individuals would benefit in the same way as employees.

Lower taxable profits mean lower income tax liability.

However, Class 2 and Class 4 National Insurance rules remain separate.

Practical Steps to Take

If changes are confirmed:

Review your tax code

Check your payslip

Adjust savings plans if disposable income rises

Monitor benefit calculations

Employers would update payroll systems automatically once new thresholds take effect.

When Could It Start

If formally announced in a Budget, changes would typically apply from the start of a new tax year in April.

Advance notice would allow payroll systems to update.

Common Questions

Will everyone save £1,486

Basic rate taxpayers earning above £20,000 could save up to that amount.

Do I need to apply

No. Personal Allowance changes apply automatically.

Does this affect National Insurance

No, NI thresholds are separate.

Is it confirmed

Only formal Budget announcements confirm tax changes.

Key Points to Remember

The Personal Allowance is currently £12,570.

Raising it to £20,000 would increase take‑home pay.

Basic rate taxpayers could save up to £1,486 per year.

National Insurance remains separate.

Formal confirmation is required before changes take effect.

Final Thoughts

A £20,000 Personal Allowance would represent a major shift in the UK tax landscape. For millions of workers and pensioners, it could mean keeping over £100 extra per month.

Whether it becomes reality depends on fiscal policy decisions and parliamentary approval. Until then, the current threshold remains unchanged.

If implemented, the change would simplify finances for many households and provide a meaningful boost to disposable income.

As always, staying informed through official announcements and reviewing your personal tax situation ensures you understand exactly how any reform affects you.

For now, it remains a proposal with potentially significant impact — one that could reshape take‑home pay for millions across the UK.